GETTDIGTAL

Financial Statement (Excel File)12M 1USER

Financial Statement (Excel File)12M 1USER

Couldn't load pickup availability

Financial Statement (Excel File)

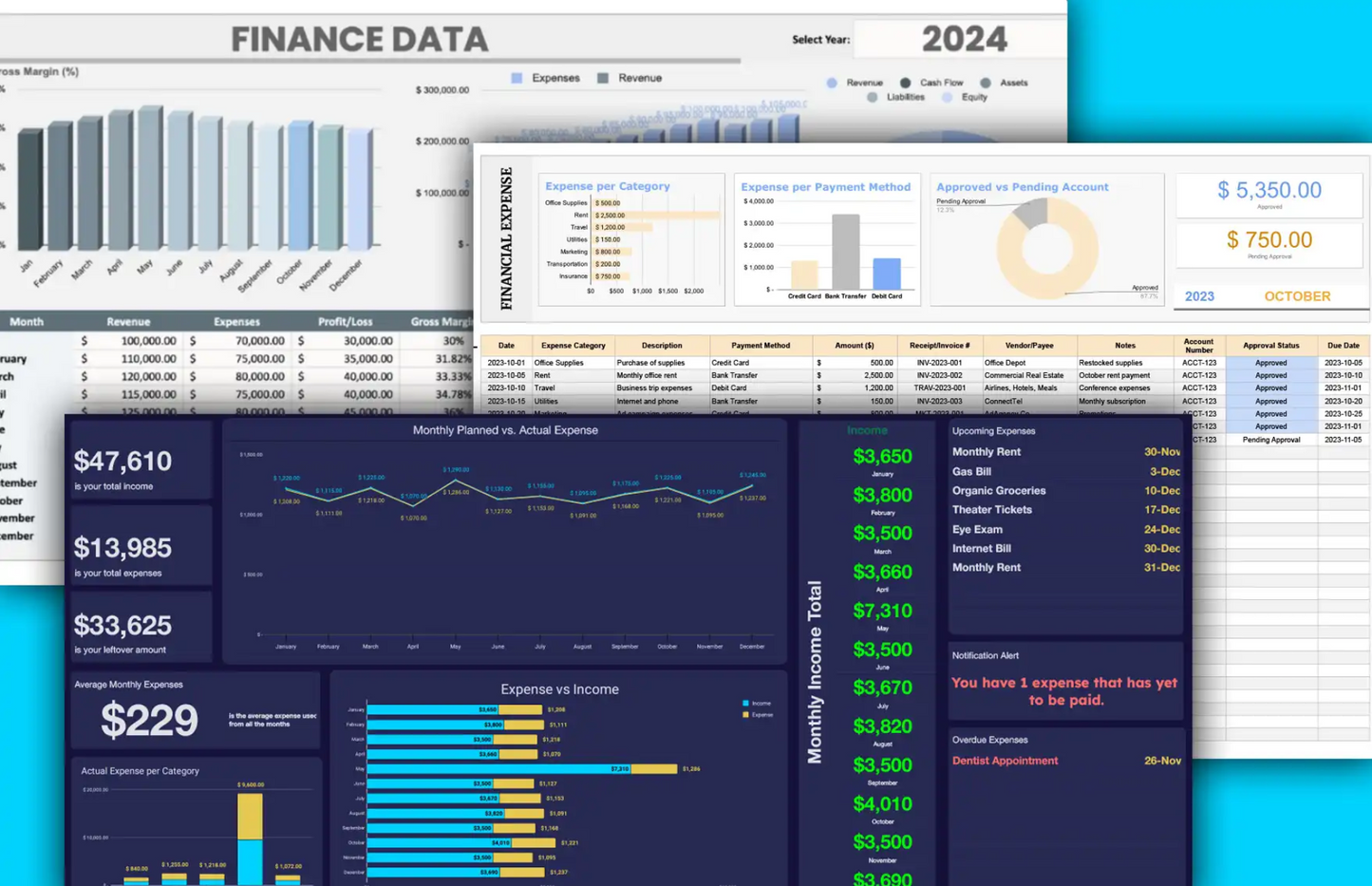

This analysis was conducted using an Excel file containing financial statements, including the Income Statement, Balance Sheet, and Cash Flow Statement. The purpose of the analysis is to assess the company’s financial performance, position, and cash flow over a specific period.

Key Steps of the Analysis:

-

Data Preparation:

-

Reviewed and organized data into standardized formats

-

Ensured accuracy of entries and consistency across statements

-

Validated formulas and cross-checked figures (e.g., total assets = total liabilities + equity)

-

-

Income Statement Analysis:

-

Assessed revenues, cost of goods sold (COGS), and gross profit

-

Analyzed operating expenses and calculated net income

-

Determined profitability ratios (e.g., gross margin, net profit margin)

-

-

Balance Sheet Analysis:

-

Evaluated assets (current and non-current), liabilities, and equity

-

Calculated key ratios: current ratio, debt-to-equity, and return on assets

-

Analyzed liquidity and financial structure

-

-

Cash Flow Analysis:

-

Examined cash flow from operating, investing, and financing activities

-

Assessed the company’s ability to generate cash and sustain operations

-

Identified any red flags in liquidity or funding

-

-

Visualization and Reporting:

-

Created summary tables and charts for easy interpretation

-

Developed dashboards to show trends and financial health indicators

-

Highlighted key insights and provided recommendations

-

Key Findings Include:

-

Areas of strong financial performance

-

Potential financial risks or inefficiencies

-

Actionable suggestions for improving profitability and financial stability